Long story short: guestpost writer Joachim Blazer thinks they are. Here’s why.

I just received an offer to invest in a convertible for a seed-stage startup.

Highlights: $200k loan, 5% interest, 3-year term, 20% discount and $2.5m cap.

So, market standard terms.

What is the deal with the convertible?

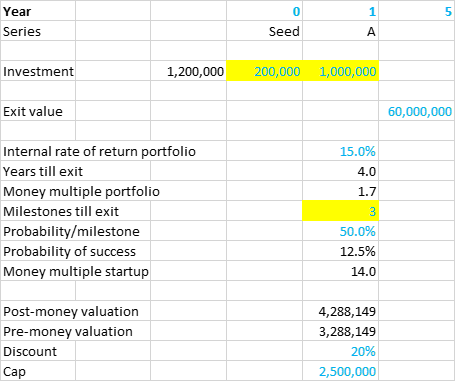

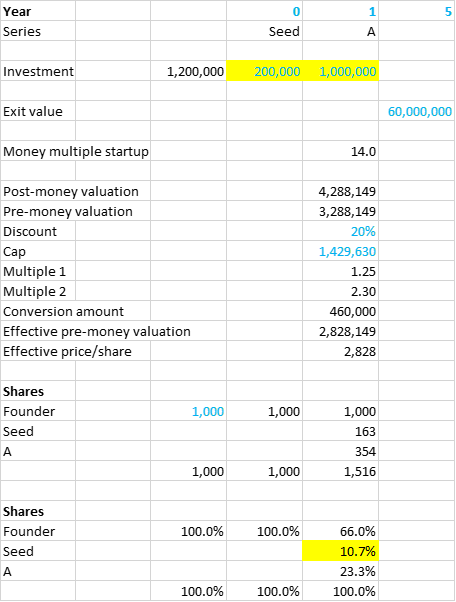

How much does the startup needs to raise in total? Assume $200k now for the first milestone/Series Seed and $1.0m in 1 year for the second milestone/Series A.

What is the exit value? Assume $60.0m in 5 years.

Series A

What internal rate of return does a Series-A investor want to make on his portfolio? Assume 15.0%.

When will the Series-A investor sell his shares? Assume after 4 years.

A 15.0% internal rate of return on his portfolio and 4 years till exit means the Series-A investor has to make a 1.7x money multiple on his portfolio.

How many milestones does the startup have to achieve between Series A and exit? Assume 3 milestones.

What is the probability of success per milestone? Assume 50.0%.

Three milestones with a 50.0% probability per milestone result in a 12.5% probability of success for the startup at the time they raise Series A.

A 1.7x money multiple and a 12.5% probability results in a 14.0x money multiple for the startup.

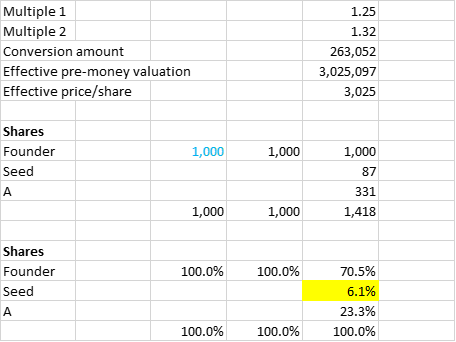

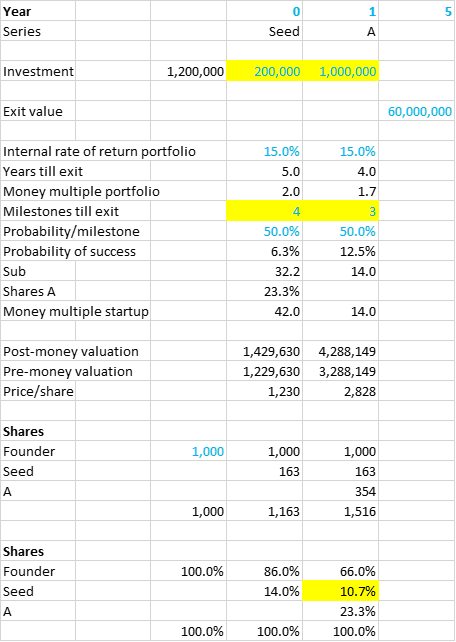

Series Seed

To simplify things I just look at the discount and cap I get on the convertible.

I can choose between:

A. 20% discount. That is the same as getting 1 / (1 – 20%) = 1.25x as many shares as the Series-A investor.

B. $2.5m valuation cap. At a $3.3m pre-money valuation for the Series A, that is the same as getting $3.3m / $2.5m = 1.32x as many shares as the Series-A investor.

I choose option B because that gives me the most shares.

So I convert $200k * 1.32 = $263k into shares.

Shares

A $60.0m exit value and a 14.0x money multiple result in a $4.3m post-money valuation.

A $4.3.m post-money valuation, $1.0m Series-A investment and $263k conversion amount result in an $3.0m effective pre-money valuation.

A $3.0m effective pre-money valuation and 1.000 shares outstanding before the Series A result in a $3,025 effective price per share.

The Series-A investor gets $1.0m / $3,025 = 331 shares (23.3%).

I get $263k / $3,025 = 87 shares (6.1%).

What is the equivalent regular share deal?

How many shares would I get if I invest $200k through a regular share deal?

Given the 42.0x money multiple that is required for this seed-stage investment, I end up with 10.7% of the shares.

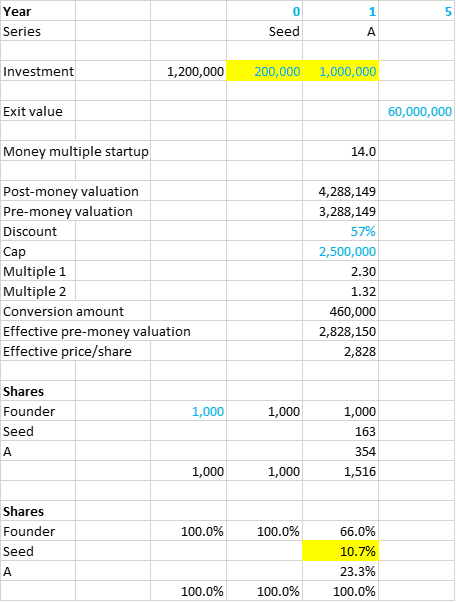

Overvalued

With the convertible I get 6.1% of the shares.

The equivalent ordinary share deal gets me 10.7% of the shares.

That means this convertible is substantially overvalued.

The discount must be 57% instead of 20% before I would get proper value for money:

Or the cap must be $1.4m instead of $2.5m:

So, even though the terms are market standard, as an investor I pass on this convertible. I get far too little compensation for the risk I take.

As a cynical founder I would of course try to sell as many convertibles as possible at these terms.

TL;DR: Are convertibles overvalued? Absolutely.

Joachim Blazer is a corporate finance advisor. He helps founders raise money. Contact him at [email protected]. The original article appeared on his blog first.

Main image: Pixabay